- BioPharm International-06-01-2012

- Volume 25

- Issue 6

New Biopharmaceuticals

A review of new biologic drug approvals over the years, featuring highlights from 2010 and 2011.

Cumulatively, the years 2010 and 2011 witnessed the approval of 19 biopharmaceutical marketing applications by FDA in the United States and EMA in the European Union combined (see Table I). 2010 was the better of the two years, with 13 total approvals. While neither year compares favorably to 2009, during which 20 such products were approved, these approval numbers are in line with average approval rates reported during the past several years (1–4). Products approved within the 2-year period included 9 antibodies, 4 fusion proteins, and 3 enzymes, as well as an enzyme inhibitor, a hormone, and a colony stimulating factor. Cancer and cancer-related conditions represented the principle indication (6 products), while the remaining products target a wide variety of conditions.

Table I

In terms of expression systems used, 14 of the 19 newly approved products are produced using mammalian (mainly Chinese hamster ovary, CHO) cell lines, two are expressed in Escherichia coli, while Saccharomyces cerevisiae, an insect cell-based expression system and a transgenic system is used to produce one product in each case. In overall terms, these figures reflect the ongoing dominance of mammalian-based expression systems in biopharmaceutical manufacture.

Digging a little deeper reveals that only 11 of the 19 therapeutic proteins were genuinely new biomolecular entities approved for the first time within the indicated timeframe. Three of the products (Actemra/RoActemra, Arzerra, and Victoza used to treat rheumatoid arthritis, chronic lymphocytic leukemia, and type 2 diabetes, respectively), although newly approved in one region over the past 2 years, had gained approval prior to 2010 in the other region (see Table I). Also approved, Nivestim is a biosimilar product used to treat neutropenia; while Prolia, used to treat osteoporisis, and Xgeva, used to treat bone loss associated with cancer, are effectively the same product with different indications. Lumizyme replaces the previously approved Myozyme, used to treat Pompe disease, while Scintimun, although gaining EU-wide centralized marketing authorization in 2010, had gained marketing authorizations in selected EU countries (the Czech Republic, Hungary, and Sweden) as far back as 1994.

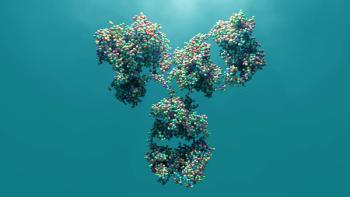

ANTIBODY PRODUCTS

Of the nine antibodies that made it to market, one is chimaeric, one is humanized, and six are fully human. The period also witnessed the approval of a first generation murine antibody produced by traditional hybridoma technology (Scintimun). Such first generation monoclonal antibody (mAb) products are more characteristic of the 1980s and early 1990s than they are of this or indeed the past decade. Engineered antibodies (chimaeric/humanized/fully human) have predominated since that time due to the characteristic clinical disadvantages exhibited by fully murine products (e.g., immunogenicity, the inability to trigger effector functions in humans, and rapid removal from circulation). Given its in vivo diagnostic role (which does not rely upon triggering effector functions) and that it is radiolabeled, such characteristics are less significant in the context of the product in question.

Adcetris is notable in that it is a (CD30-directed) antibody-drug conjugate (used to treat Hodgkin's lymphoma). The conjugated toxin is monomethyl auristatin E (MMAE), an anticancer agent. On average, four molecules of MMAE are attached to each antibody molecule. Binding of the antibody conjugate to CD30-expressing cells is followed by endocytotic internalization and subsequent release of MMAE via proteolytic cleavage. MMAE is a microtubule disrupting agent. Binding to tubulin disrupts the microtubule network within the cell, inducing cell cycle arrest and death by apoptosis.

FUSION PRODUCTS

Of the four fusion products approved, two are Fc-fusion based (Eylea and Nulojix) with the antibody Fc portion of the products serving to extend the serum half life of the overall molecule. Nulojix, used to prevent organ rejection following kidney transplant, is interesting in that it evolved from Orneca, which was approved in 2005 for the treatment of rheumatoid arthritis. Orneca negatively regulates the activation of a range of T lymphocytes. Nulojix is a protein engineered version of Orneca, identified through mutagenesis and screening, which binds with greater avidity to a range of T lymphocytes. This engineering apparently underpins a more potent immunosuppresive effect.

Eylea and Nulojix join several previously approved Fc fusion products. The additional two fusion products (Elonva and Provenge) are more novel in this context. Elonva, used to achieve controlled ovarian stimulation in some fertility treatments, is a modified recombinant human follicle stimulating hormone (FSH) in which the carboxy-terminal peptide of the β subunit of human chorionic gonadotropin (hCG) is fused to the FSH β chain. The resulting fusion product retains its ovarian stimulation activity, but displays an improved blood elimination half life.

Provenge, used to treat hormone-refractory prostate cancer, is a more complex product in that it consists of twin active components: autologous antigen-presenting dendritic cells and the recombinant fusion protein, PAP-GM-CSF. The latter consists of human prostatic acid phosphatase (PAP), an antigen expressed in some 95% of prostate cancer tissue, linked to human granulocyte-macrophage colony-stimulating factor (GM–CSF) through a dipeptide (glycine-serine) linker sequence. The treatment approach consists of three phases: an initial collection of dendritic cells from the blood of the prostate cancer patient (dendritic cells are the only antigen-presenting cells that can prime native T lymphocytes to initiate an immune response); in vitro exposure of the collected cells to the fusion product, which results in their activation (the GM–CSF portion of the protein helps to target the PAP protein to the dendritic cells and activate those cells; the PAP portion provides the tumor specificity that will eventually direct the immune system to target prostate cancer) and the final phase, that is, the re-infusion of the activated cells back into the original donor patient.

CONJUGATED PRODUCTS

In addition to Adcetris (described earlier), two additional products approved throughout 2010 and 2011 are engineered using an in vitro conjugation process post protein synthesis. In both instances, the purpose of conjugation is to extend product serum half life. Krystexxal (a recombinant urate oxidase enzyme used to treat gout) is PEGylated with a 10kDa monomethoxy-polyethylene glycol (m-PEG) moiety whereas Victoza (used to treat type 2 diabetes) consists of glucagon like peptide 1 to which a C-14 fatty acid is conjugated.

MARKET VALUE

Although the cumulative biopharmaceutical market value for 2011 is not readily available as yet, cumulative global sales of recombinant therapeutic proteins reached a notable milestone in 2010 (5). In that year, recombinant proteins surpassed the $100 billion mark, reaching an estimated $107 billion. Moreover, that same year 30 individual biopharmaceutical products recorded sales of more than $1 billion each, with Enbrel (etanercept) retaining the top spot and boasting sales value of almost $7.3 billion (5).

In terms of APIs, 2010 figures equate to approximately 21 metric tons (21,000 kg) of pure protein product. Almost two-thirds of that amount—approximately 13.5 tons—is produced in microbial systems (mainly insulin) with the remaining third being produced almost exclusively using animal cell culture (mainly mAbs) (6).

HOW THINGS HAVE CHANGED SINCE THE 1980S

Given that 2012 represents the 25th anniversary of Biopharm International, it seems appropriate to conclude this article by briefly considering the new biologic drug approval profiles from the 1980s, and contextualizing them against the more recent approvals considered above.

The first ever biopharmaceutical to gain approval for general medical use was that of Humulin (recombinant human insulin) in 1982. Throughout that decade, nine such products were approved in the US (see Table II). These products were expressed mainly in E. coli or mammalian cell lines, with one product being produced in yeast. These expression systems remain dominant to this day.

Table II: Biopharmaceuticals approved by FDA in the US during the 1980s. This era predates the EMA centralized approval system in the EU, although many of these products were also approved in several individual EU member states during this period. Note: EPO is erythropoietin, GH is growth hormone, IFN is interferon, rh is recombinant human, and tPA is tissue plasminogen activator.

Products approved in the 1980s were mainly hormones and cytokines, with only one antibody based product among them. The intervening decades have witnessed a steady increase in biopharmaceutical approval rates, and certainly in their market value.

One of the most striking changes is the current dominance of antibody-based products. During the past 5 years, for example, one-third of all approvals have been antibody-based, 6 of the top 10 selling biopharmaceuticals globally are antibodies and antibodies represent by far the single largest category of biopharmaceuticals currently in development. Likewise, target indication profiles have changed. Today, cancer-targeted therapeutics dominate the market, while only two of the nine approvals throughout the 1980s targeted this condition.

Another technical trend underlined by comparing products shown in Tables I and II is the evolution of engineered biopharmaceuticals. The vast majority of products approved throughout the 1980s were un-engineered first generation products, displaying an identical amino acid sequence to mainly native human regulatory proteins such as insulin and human growth hormone. The 1990s witnessed the approval of the first wave of engineered products (e.g., fast and slow acting insulin analogues chimaeric and humanized antibodies as well as PEGylated products). An ever-increasing proportion of product approvals are now engineered to tailor their therapeutic properties in a predefined way. Fourteen of the 19 products (almost 75%) approved in 2010 and 2011 are engineered.

The biopharmaceutical sector has certainly matured rapidly since the 1980s. Depending on the specific year considered, anywhere between 20–25% of all genuinely new drug approvals in the EU and US are produced by modern biotechnological means. For example, Abbott's antibody product Humira (adalimumab), has a projected sales value of $9 billion for 2012 that will almost certainly displace Pfizers' Lipitor and Sanofi/BMS' Plavix as the world's most lucrative drug this year.

The pace of discovery and innovation in the biotechnology research sphere continues to increase exponentially. The next 25 years will almost certainly witness the discovery, development, and approval of biopharmaceuticals that we cannot even envisage. In 25 years time, the authors of the 50th Biopharm International special edition will have much to discuss.

GARY WALSH works in the Industrial Biochemistry Program of the Department. of Chemical and Environmental Sciences, Materials and Surface Science Inst., Univ. of Limerick, Limerick City, Ireland, and is a member of the BioPharm International editorial advisory board,

REFERENCES

1. G. Walsh, Biopharm Intl. 23 (10) 30–41 (2010).

2. G. Walsh, Biopharm Intl. 22 (10), 68–77 (2009)

3. G. Walsh, Biopharm Intl. 21 (10), 52–65 (2008).

4. G. Walsh, Biopharm Intl. 20 (10), 56–67 (2007).

5. R&D Pipeline News, Special Edition (La Merie Business Intelligence, March 2010),

6. T. Ransohoff, "Global Trends in Mammalian Cell Culture Capacity and Biomanufacturing" (2011), presentation available at

Articles in this issue

over 13 years ago

BioPharm International, June 2012 Issue (PDF)over 13 years ago

Back-to-Basics with PDUFA Vover 13 years ago

Determining Process Quality Metrics for CMOsover 13 years ago

Reducing Human Errorover 13 years ago

Know the Regulationsover 13 years ago

Creating a Product Portfolio from the Ground Upover 13 years ago

25 Years of Nanoparticles: A Look Forwardover 13 years ago

25 Years of BioPharma Industry Growthover 13 years ago

Developing Alternatives to ELISA-Based Biomarker AssaysNewsletter

Stay at the forefront of biopharmaceutical innovation—subscribe to BioPharm International for expert insights on drug development, manufacturing, compliance, and more.