Is the contract-only CMO an endangered species?

Jim Miller is president of PharmSource Information Services, Inc., and publisher of Bio/Pharmaceutical Outsourcing Report.

Is the contract-only CMO an endangered species?

Measuring the size of the market for contract manufacturing services requires a careful hand.

![JimMiller-D-[114739850]-787740-1408598506821.jpg](https://cdn.sanity.io/images/0vv8moc6/biopharn/5ec65520a609e4c058df4707c47d1c52ce19a4d1-123x150.jpg?w=350&fit=crop&auto=format)

The weak global economy adds to the challenges of bio/pharma companies and their suppliers.

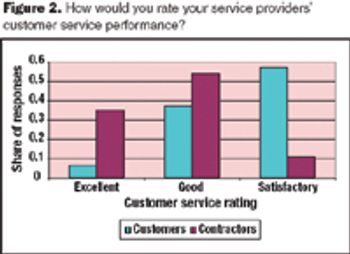

Service providers must focus on delivering a superior customer experience.

The evolving bio/pharmaceutical business model poses risk for CMOs.

Some recent private-equity buyouts of CROs show both the upside and downside for investors.

A dearth of late-stage candidates could hurt the pharmaceutical services market in the future.

CROs that have made big acquisitions could be outmaneuvered by evolving sourcing models.

The EU debt crisis portends of possible negative repercussions for the dose CMO industry.

Addressing supply-chain challenges.

Indian manufacturers are not now a threat to Western CMOs, but may be long term.

CDMOs and CMOs face weak economic recovery, consolidation, and globalization.

Covance's deal with Sanofi-Aventis demonstrates the power of scale and scope.

Venture capital is still scarce for early biotechs and their providers.

This month, we catch up on major developments around the world and their implications for the contract services industry.

How much to spend on early development, whether to use your CMO's proprietary cell line, and other outsourcing advice.

Being open to unforseen events may avert risk or create opportunities.

The ability to deal with the complexity of the clinical supply process has shifted the balance of power to clinical supply chain specialists.

As facility closures and layoffs continue, CRO and CMO executives are hoping for a better year, despite few positive signs.

A new analysis highlights growth opportunities and challenges for contract development and manufacturing organizations.

Lonza's bid for Patheon makes the contract manufacturing industry re-examine the one-stop manufacturer model.

Contract research, development, and manufacturing organizations betting on a comeback in venture capital financing will have a long wait.

UK-based CMOs seek opportunities in new markets.

What the current lack of venture capital means for the CRO market.

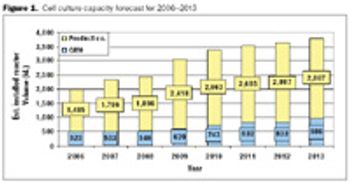

There could be a serious glut of commercial scale mammalian cell culture capacity over the next five years. Then again, there could be a significant shortage. It all depends on how things develop in expression technology, the new product pipeline, and corporate strategies.

The supply base for preclinical and clinical development services continues to expand in China.

A CMO faces significant risk of lost revenues and profits if the product fails in clinical trials or doesn't meet sales projections.

There wasn't much of a contract services industry when BioPharm International began publishing 20 years ago. Today's big names in biomanufacturing, including Lonza, Boehringer-Ingelheim, and Avecia, had not yet entered the business.

Meeting service levels is a major challenge for pharmaceutical services providers because the requirements of their client base vary widely.

The BIO annual meeting in early May had an upbeat tone. Investment capital is flowing into the industry at high levels, resulting in strong demand for contract development services. The funding stream is particularly strong in the US, and that is attracting more European contract manufacturers (CMOs) eager to improve business development here.